Explore How Our Solutions Meet Your Business Financial Management Requirements

e-Invoice

e-Invoice Implementation Timeline. e-Invoice will be implemented in phases to ensure smooth transition.

Below is the e-Invoice implementation timeline:

|

Targeted Taxpayers |

Implementation Date |

|

Taxpayers with an annual turnover or revenue of more than RM100 million |

1 August 2024 |

|

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million |

1 January 2025 |

|

Taxpayers with an annual turnover or revenue of more than RM500,000 and up to RM25 million |

1 July 2025 |

|

Taxpayers with an annual turnover or revenue of up to RM500,000 |

1 January 2026 |

| Note: e-Invoice implementation timeline been updated on 21 February 2025 | |

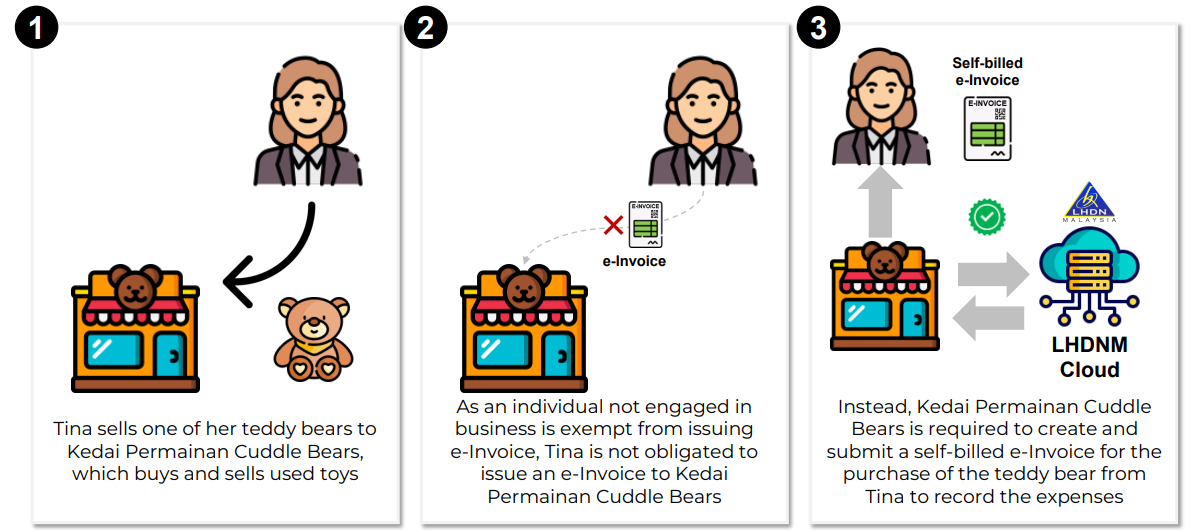

Buyer need to issue a self-billed e-Invoice when purchasing products from an individual who is not conducting a business

AP Management

AP (Accounts Payable) Management is a comprehensive solution to streamline your vendor payment processes. It helps you manage vendor transactions, ensure accuracy, and maintain compliance with financial regulations.

Key Features:

- Vendor List Management: Maintain a complete record of all vendors, including approved vendors and their details.

- Product Information: Track vendor products, prices, and other details for accurate invoicing.

- Purchase Orders: Create, manage, and track Purchase Orders (PO) for smooth transactions.

- Invoice Recording: Record and track vendor invoices to ensure accurate payment processing.

- Payment Processing: Schedule and execute vendor payments on time to avoid delays and maintain strong vendor relationships.

- Transaction Tracking: Keep detailed records of all transactions for future reference and audits.

- Automation: Automate repetitive tasks to reduce errors and save time.

- Financial Control: Monitor cash flow and expenses to support better financial management.

- Reporting & Analysis: Generate detailed reports to analyze payment trends and assess vendor performance.

- Compliance: Ensure all processes meet financial policies and regulatory requirements.

- Vendor Relationship Management: Build stronger relationships with vendors through prompt and accurate payments.

Benefits:

- Save time with automated payment processes.

- Reduce manual errors and improve accuracy.

- Stay compliant with financial regulations.

- Improve cash flow management.

- Enhance vendor relationships with timely payments.

- Gain better financial insights with detailed reports.

With BMO-Accounting’s AP Management, you can simplify your payment processes, reduce administrative workload, and focus on growing your business.

AR Management

AR (Accounts Receivable) Management is a comprehensive solution to streamline your customer invoicing and payment collection processes. It helps you manage customer transactions, improve cash flow, and maintain strong customer relationships.

Key Features:

- Customer Invoicing: Create and send professional invoices to customers effortlessly.

- Payment Tracking: Monitor outstanding payments in real-time to ensure timely collections.

- Automated Reminders: Send automated payment reminders to customers to reduce delays.

- Aging Reports: Generate detailed aging reports to track overdue payments.

- Multi-Currency Support: Handle invoices and payments in different currencies with ease.

- Payment Reconciliation: Sync with your bank to reconcile payments seamlessly.

- Customer Statements: Generate and send customer statements for better transparency.

- Credit Management: Set credit limits and monitor customer credit balances.

- Reporting & Analysis: Generate reports to analyze payment trends and customer behavior.

- Compliance: Ensure all processes meet financial policies and regulatory requirements.

- Customer Relationship Management: Build stronger relationships with customers through efficient invoicing and payment processes.

Benefits:

- Improve cash flow with timely payment collections.

- Reduce manual effort with automated invoicing and reminders.

- Enhance customer satisfaction with professional and accurate invoicing.

- Gain better financial insights with detailed reports and analytics.

- Stay compliant with financial regulations and policies.

- Strengthen customer relationships through efficient payment processes.

With BMO-Accounting’s AR Management, you can simplify your invoicing and payment collection processes, reduce administrative workload, and focus on growing your business.

Invoicing

Invoicing is a critical part of your business operations. With BMO-Accounting, you can create, manage, and track invoices effortlessly, ensuring timely payments and better cash flow management.

Key Features:

- Professional Invoices: Create and send professional, customizable invoices to customers.

- Multi-Currency Support: Generate invoices in different currencies for international customers.

- Tax Calculation: Automatically calculate taxes based on your business location and regulations.

- Payment Tracking: Track invoice statuses (paid, unpaid, overdue) in real-time.

- Customizable Templates: Use customizable invoice templates to match your brand identity.

- Reporting & Analytics: Generate reports to analyze invoice performance and payment trends.

- Compliance: Ensure invoices meet legal and regulatory requirements.

Benefits:

- Improve cash flow with faster invoice processing and payments.

- Save time with automated invoicing and reminders.

- Enhance professionalism with branded and customizable invoices.

- Reduce errors with automated tax calculations and invoice generation.

- Gain better financial insights with detailed reports and analytics.

- Strengthen customer relationships with efficient and transparent invoicing.

With BMO-Accounting’s Invoicing features, you can streamline your billing processes, reduce administrative workload, and focus on growing your business.

Quotation

Quotations are essential for winning new business and providing accurate cost estimates to your customers. With BMO-Accounting, you can create, manage, and track quotations efficiently, ensuring professionalism and accuracy.

Key Features:

- Professional Quotations: Create and send professional, customizable quotations to customers.

- Template Customization: Use customizable templates to match your brand identity.

- Multi-Currency Support: Generate quotations in different currencies for international customers.

- Tax Calculation: Automatically calculate taxes based on your business location and regulations.

- Product & Service Listings: Easily add products or services with descriptions and pricing.

- Validity Period: Set expiration dates for quotations to ensure timely follow-ups.

- Conversion to Invoice: Convert approved quotations into invoices with a single click.

- Customer Management: Maintain customer details for quick and accurate quotation creation.

- Reporting & Analytics: Generate reports to analyze quotation performance and conversion rates.

- Compliance: Ensure quotations meet legal and regulatory requirements.

Benefits:

- Win more business with professional and accurate quotations.

- Save time with customizable templates and automated tax calculations.

- Improve efficiency with quick conversion of quotations to invoices.

- Enhance customer satisfaction with clear and detailed quotations.

- Gain better insights with quotation performance reports and analytics.

- Strengthen customer relationships with timely and professional communication.

With BMO-Accounting’s Quotation features, you can streamline your quotation processes, improve accuracy, and focus on growing your business.

Payment Voucher to Vendors

Payment vouchers are essential for managing and tracking payments to vendors. With BMO-Accounting, you can create, manage, and track payment vouchers efficiently, ensuring accuracy and compliance.

Key Features:

- Vendor Payment Tracking: Record and track all payments made to vendors.

- Payment Voucher Creation: Easily create payment vouchers for vendor transactions.

- Multi-Currency Support: Handle payments in different currencies for international vendors.

- Tax Calculation: Automatically calculate taxes based on your business location and regulations.

- Approval Workflow: Set up approval workflows for payment vouchers to ensure proper authorization.

- Transaction History: Maintain a detailed record of all payment transactions for future reference.

- Reporting & Analytics: Generate reports to analyze payment trends and vendor performance.

- Compliance: Ensure all payment processes meet financial policies and regulatory requirements.

- Vendor Relationship Management: Build stronger relationships with vendors through timely and accurate payments.

Benefits:

- Improve cash flow management with timely vendor payments.

- Save time with automated payment scheduling and approval workflows.

- Reduce errors with accurate tax calculations and payment tracking.

- Enhance vendor relationships with prompt and accurate payments.

- Gain better financial insights with detailed payment reports and analytics.

- Stay compliant with financial regulations and policies.

With BMO-Accounting’s Payment Voucher features, you can streamline your vendor payment processes, reduce administrative workload, and focus on growing your business.

Bank Reconciliation

Bank Reconciliation is a critical process to ensure your financial records match your bank statements. With BMO-Accounting, you can streamline this process, identify discrepancies, and maintain accurate financial records.

Key Features:

- Automated Reconciliation: Automatically match transactions between your bank statements and accounting records.

- Transaction Matching: Easily match payments, receipts, and other transactions with bank entries.

- Discrepancy Detection: Identify and resolve discrepancies between your records and bank statements.

- Multi-Bank Support: Reconcile accounts across multiple banks and currencies.

- Audit Trail: Maintain a detailed audit trail of all reconciliation activities for compliance.

- Reporting & Analytics: Generate reconciliation reports for better financial insights.

- Manual Adjustments: Make manual adjustments for unmatched transactions when needed.

- Compliance: Ensure all reconciliation processes meet financial regulations and standards.

- User-Friendly Interface: Simplify reconciliation with an intuitive and easy-to-use interface.

Benefits:

- Save time with automated transaction matching and bank feeds integration.

- Reduce errors and discrepancies with accurate reconciliation tools.

- Improve financial accuracy by ensuring your records match bank statements.

- Gain better financial insights with detailed reconciliation reports.

- Stay compliant with financial regulations and audit requirements.

- Simplify the reconciliation process with a user-friendly interface.

With BMO-Accounting’s Bank Reconciliation features, you can streamline your financial processes, ensure accuracy, and focus on growing your business.

Official Receipts

Official Receipts are essential for acknowledging payments received from customers. With BMO-Accounting, you can create, manage, and track official receipts efficiently, ensuring professionalism and accuracy.

Key Features:

- Receipt Generation: Create and issue official receipts for payments received.

- Customizable Templates: Use customizable templates to match your brand identity.

- Multi-Currency Support: Generate receipts in different currencies for international transactions.

- Tax Calculation: Automatically calculate taxes based on your business location and regulations.

- Payment Tracking: Track payments and link them to specific invoices or transactions.

- Integration with Invoicing: Automatically generate receipts for paid invoices.

- Customer Details: Include customer details for accurate record-keeping.

- Reporting & Analytics: Generate reports to analyze receipt trends and payment history.

- Compliance: Ensure receipts meet legal and regulatory requirements.

Benefits:

- Improve professionalism with branded and customizable receipts.

- Save time with automated receipt generation and tax calculations.

- Enhance accuracy by linking receipts to specific invoices and payments.

- Strengthen customer relationships with clear and professional receipts.

- Gain better financial insights with detailed receipt reports and analytics.

- Stay compliant with financial regulations and standards.

With BMO-Accounting’s Official Receipts features, you can streamline your payment acknowledgment processes, reduce administrative workload, and focus on growing your business.

SST (Sales and Service Tax)

SST (Sales and Service Tax) management is crucial for businesses to comply with tax regulations. With BMO-Accounting, you can easily calculate, track, and report SST, ensuring compliance and accuracy.

Key Features:

- Automated SST Calculation: Automatically calculate SST on sales and services based on current tax rates.

- Tax Code Management: Apply different tax codes for various products and services.

- Invoice Integration: Include SST calculations directly in invoices for transparency.

- Multi-Tax Support: Handle multiple tax types (e.g., sales tax, service tax) seamlessly.

- Tax Reporting: Generate detailed SST reports for filing and auditing purposes.

- Compliance Alerts: Receive alerts for upcoming tax deadlines and changes in tax rates.

- Tax Payment Tracking: Track SST payments and ensure timely submissions.

- Audit Trail: Maintain a detailed record of all SST-related transactions for compliance.

- Customizable Tax Rules: Set up custom tax rules to match your business needs.

- Integration with Accounting: Sync SST data with your general ledger for accurate financial records.

- User-Friendly Interface: Simplify SST management with an intuitive and easy-to-use system.

Benefits:

- Ensure compliance with SST regulations and avoid penalties.

- Save time with automated SST calculations and reporting.

- Improve accuracy in tax filings with detailed SST reports.

- Stay updated with compliance alerts for tax deadlines and rate changes.

- Simplify tax management with a user-friendly interface.

- Gain better financial control with integrated SST and accounting data.

With BMO-Accounting’s SST features, you can streamline your tax management processes, ensure compliance, and focus on growing your business.

Financial Reports

Financial Reports are essential for understanding your business’s financial health. With BMO-Accounting, you can generate detailed and accurate reports, including Profit and Loss, General Ledger, Trial Balance, Balance Sheet, and more.

Key Features:

- Profit and Loss Statement: Track revenue, expenses, and net profit over a specific period.

- General Ledger: Maintain a complete record of all financial transactions.

- Trial Balance: Ensure your debits and credits are balanced for accurate financial reporting.

- Balance Sheet: View your business’s assets, liabilities, and equity at a glance.

- Cash Flow Statement: Monitor cash inflows and outflows to manage liquidity.

- Customizable Reports: Create tailored reports to meet your specific business needs.

- Real-Time Data: Generate reports with up-to-date financial data for accurate insights.

- Export Options: Export reports in PDF, Excel, or other formats for easy sharing.

- Graphical Representation: Visualize financial data with charts and graphs for better understanding.

- Compliance: Ensure reports meet legal and regulatory requirements.

- User-Friendly Interface: Simplify report generation with an intuitive system.

Benefits:

- Gain a clear understanding of your business’s financial performance.

- Save time with automated report generation and real-time data.

- Improve decision-making with accurate and detailed financial insights.

- Ensure compliance with financial regulations and standards.

- Simplify financial analysis with graphical representations and export options.

- Focus on growing your business with reliable financial reporting tools.

With BMO-Accounting’s Financial Reports features, you can streamline your financial analysis, ensure compliance, and make informed business decisions.

POS System

The POS (Point-of-Sale) System is designed to streamline your sales transactions and retail operations. It efficiently manages sales, inventory, and customer data, and it seamlessly syncs the data to BMO Accounting for accurate financial reporting.

Key Features:

- Near Real-Time Sales Tracking: Monitor every sale as it happens to ensure timely and accurate transaction records.

- Inventory Management: Track stock levels, update product details, and receive alerts when inventory is low.

- Multi-Payment Options: Accept cash, credit/debit cards, and digital payments smoothly at the point of sale.

- Customer Management: Maintain detailed customer profiles and purchase histories for personalized service.

- Seamless Integration: Automatically sync sales, inventory, and customer data with BMO Accounting for a unified financial view.

- Detailed Reporting: Generate sales reports, inventory summaries, and customer analytics to better understand business performance.

- User-Friendly Interface: Enjoy an intuitive system that is easy to learn and use, minimizing training time and errors.

- Offline Mode: Continue processing transactions even when internet connectivity is interrupted.

- Security: Benefit from robust security measures that protect transaction data and customer information.

- Customizable Settings: Tailor the system to meet your unique business requirements, including pricing, taxes, and discounts.

Benefits:

- Enhance transaction speed and improve customer service.

- Improve inventory control and reduce discrepancies.

- Gain valuable insights into sales trends and customer preferences.

- Simplify accounting by syncing POS data directly with BMO Accounting.

- Reduce manual errors and save time on administrative tasks.

- Streamline retail operations for increased overall efficiency.

With the integrated POS System, you can optimize your retail operations, provide an enhanced customer experience, and maintain accurate accounting records with ease.

Multiple Login & Permissions

BMO Accounting supports multiple login accounts along with a robust permissions system. This feature allows administrators to control who accesses the system, assign different roles, and set specific permissions for various functionalities. This ensures secure and efficient operations while protecting sensitive financial data.

Key Features:

- Multi-User Login: Enable multiple users to access the system using individual credentials.

- Role-Based Access Control: Assign distinct roles to users with predefined permissions tailored to their job functions.

- User Management: Add, modify, or remove user accounts easily from a centralized dashboard.

- Custom Permissions: Configure granular access rights for different modules, reports, and system functions.

Benefits:

- Improve security by controlling access to sensitive data.

- Enhance accountability with comprehensive audit trails and user activity logs.

- Streamline administrative tasks with an intuitive user management system.

- Tailor user access to specific roles, ensuring employees see only what they need.

- Maintain compliance with regulatory requirements through controlled access and monitoring.

- Foster collaboration without compromising the security of critical financial information.

With BMO Accounting’s support for multiple login and a comprehensive permissions system, you can secure your business data, ensure regulatory compliance, and streamline user management, ultimately enhancing your overall operational efficiency.